Are you constantly worrying about money?

You’re not the only one. Money is one of the most common concerns that people face – particularly if you’re one of the many households that only just scrapes by from one payday to the next.

Whether you’re dealing with a limited income, or you know that you’re not great with financial decision making, it’s important to put steps in place that reduce your anxiety about your cash situation. After all, the more stress you experience, the more likely you are to make yourself unwell. That means more absences from work, and even less money to stretch across all your bills each month.

Here, we’re going to look at the 3 steps you can take to regain control of your finances.

Signs Financial Stress is Getting you Down

Before we look at the steps you can take to reduce financial stress, let’s evaluate how bad your current situation is. For instance, ask yourself:

- Am I losing sleep because I’m worried about cash?

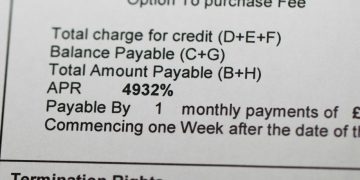

- Am I always borrowing on my overdraft or credit card?

- Am I constantly looking ahead to my next pay day?

- Would I be in a crisis if I had a flat tire or unexpected expense?

- Would my situation be dire if I lost my job?

If you answer “yes” to any of those questions, this is the article for you.

Step 1: Change your Passive Relationship with Spending

One of the worst things you can do when you’re struggling to make ends meet is spend money passively. This means that you just let your payments come out of your bank every month or whenever you need something, without thinking about how much you’re spending.

Excellent budgeting begins with knowing exactly where your money goes. Tracking your outgoing expenses is the key to ensuring that you don’t make unnecessary mistakes with your cash. What’s more, “active” spending will encourage you to do more comparison shopping whenever you make a purchase.

Whether you’re buying groceries at your local supermarket, paying for your car insurance, or even taking out a personal loan, you should never just assume that the price you find first is the best deal you can get. Take the time to shop around, use sites like Readies and nine times out of ten; you’ll be able to find something better elsewhere. Thanks to the internet, you don’t even need to waste a lot of time on your comparisons.

Step 2: Focus on Adjusting your Budget

If you’re struggling with money and losing sleep over your concerns about cash, then there’s a good chance that your budget just isn’t up to snuff. Fortunately, you can change that by looking at your incoming and outgoing expenses and making some basic changes.

Even if you think that you’re keeping costs as low as possible right now, looking at your budget again could help you to see somewhere that you can reduce expenses even further. For instance, maybe you can get rid of your regular TV subscription and replace it with Netflix instead. Perhaps you can give up your gym membership and work out at home or with your friends in the park.

Regularly checking your budget each month will also help you to see where your common problem areas are. For instance, you might discover that everything is fine each month until you decide that you can’t resist going out with your friends for a blow-out drinking session. If that’s the case, you can allocate yourself a specific amount of cash to take with you on those night’s out and leave your cards at home.

Step 3: Find Ways to Increase your Income

If no matter what you do, you can’t seem to find a way to reduce costs, then your only option could be to search for an additional source of income. Perhaps your partner who stopped working to look after the kids could begin taking on work part-time again. Maybe you could sign-up for a freelancing website and take on jobs when you’re not busy at your 9-to-5 career.

These days, there are a lot more ways to make extra income than there used to be. If you have your own car, you can even get approved for a ride-sharing service and earn some extra cash by taking people to their destinations.

Take a look online and find the opportunities available in your area that sound most appealing to you and your family. Even a little extra cash can go a long way.

Comments 1